Financial Statements and Express Analysis

Exploring the Financial Statements section with the Seldon.Basis team.

Subscription required

Hidden information is available only to subscribed users. Purchase a subscription to get full access to the service.

Buy

Subscription required

Available with the 1-month and 1-year subscription.

Exploring the Financial Statements section with the Seldon.Basis team.

Exploring the Financial Statements section with the Seldon.Basis team.

One important criterion for commercial prudence in selecting a counterparty is the confirmation of data on the company's financial and economic activities. This will allow the taxpayer to exclude transactions with "technical" companies and avoid additional financial charges.

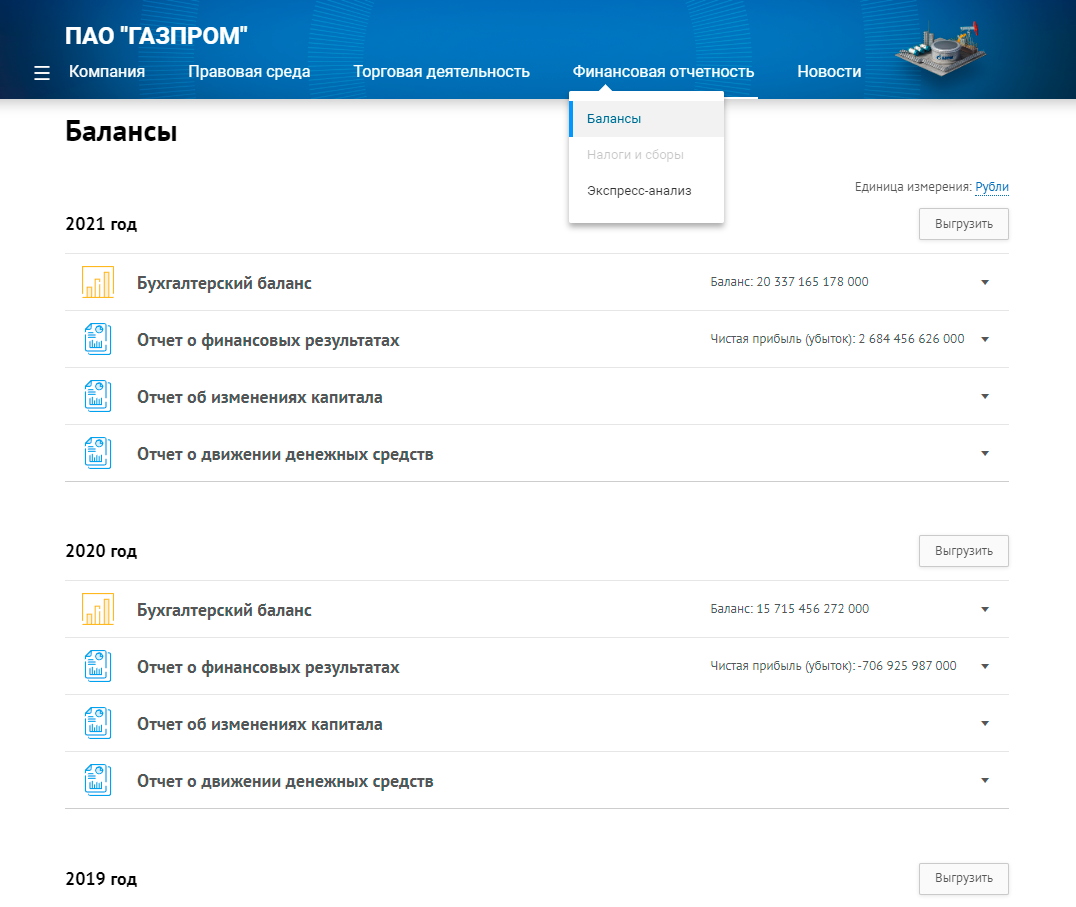

The data that will allow you to check the company's activity is displayed in the Financial Statements section. For convenience, indicators and reports are divided into three tabs: Balances, Taxes and fees and Express Analysis.

What should you pay attention to first?

The first thing to look at is the Balances tab of the company profile. Data have been collected since 2001 on more than 28 million companies.

In Seldon.Basis there are four types of reports according to the public data of the Federal Tax Service.

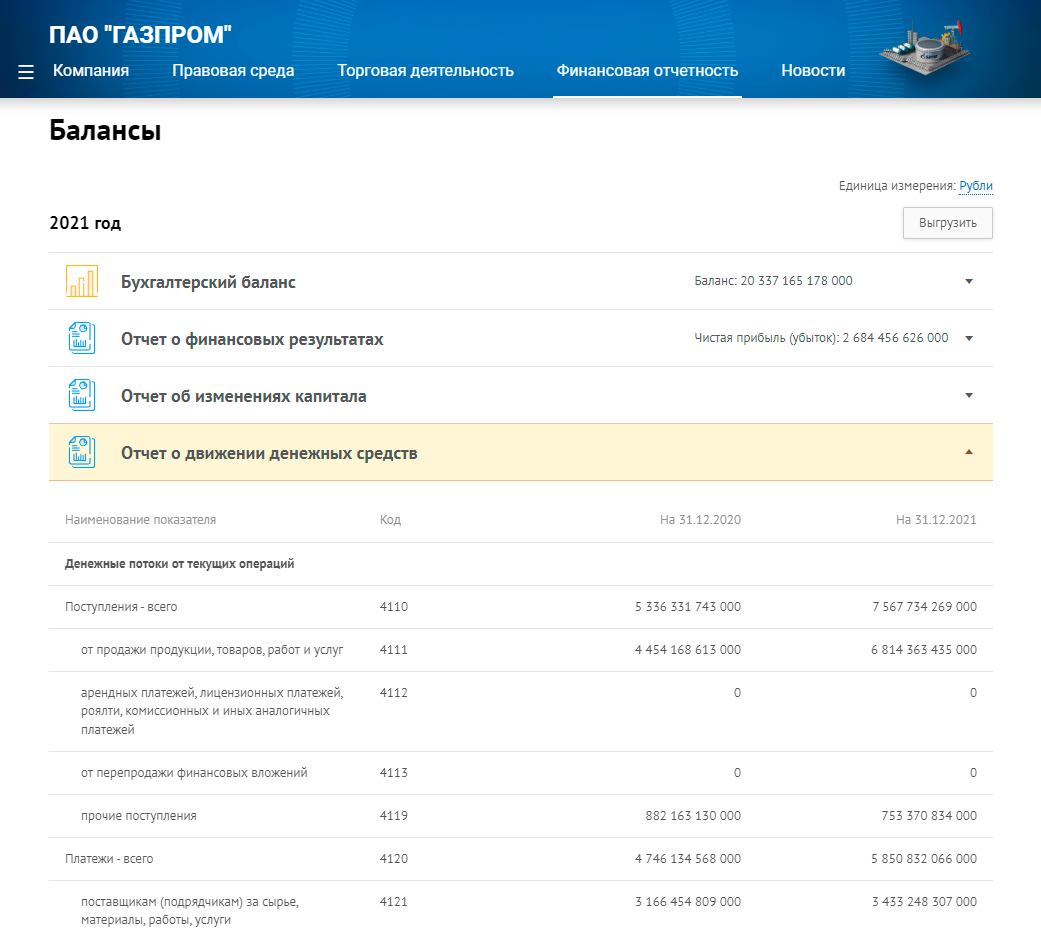

To make sure that the company has the resources and production capacity, conduct a comparative analysis in the Non-current assets over two years.

A company that claims to be a manufacturer, cannot have a zero mark here, since the non-current assets include buildings, vehicles, production equipment, and others, that is, property that initially brings the company revenue for more than a year.

If it is revealed that the company has no fixed assets, then conduct an additional check and request documents from the counterparty. Also compare the data year by year upward or downward. This will suggest that the company is expanding its facilities or for some reason is downsizing.

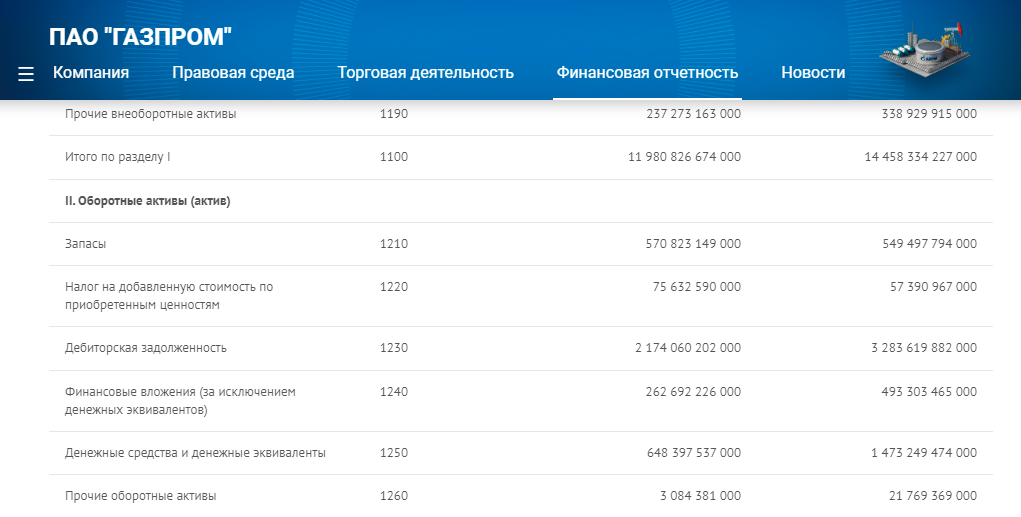

To have an idea of the solvency of the counterparty, analyze information on accounts receivable and accounts payable. Take the data on the increase in these indicators by year, it will help to draw up an agreement on your terms and minimize the subsequent risks of receivables in your company. After all, if the company does not pay for the contracts of its counterparties, then the company will pay its own contracts with a delay.

The Statement of Financial Performance allows you to compare data on revenue and net profit by year. This is one of the indicators of the company's development or loss.

If you see zero statements, the company is not operating and has no income. Customers have questions when they audit a company and are faced with a lack of 2021 financial statements. In this case, you need to check with the client to see if they are reporting to GIRBO. From January 1, 2022 the Federal law No. 352-FZ of 02.07.2021 stipulates that companies may not submit data to the state authorities if the statements are provided to GIRBO. Also the Government of the Russian Federation by its Decree No. 395 dated 18.03.2022 limited access to information in GIRBO until December 31, 2022.

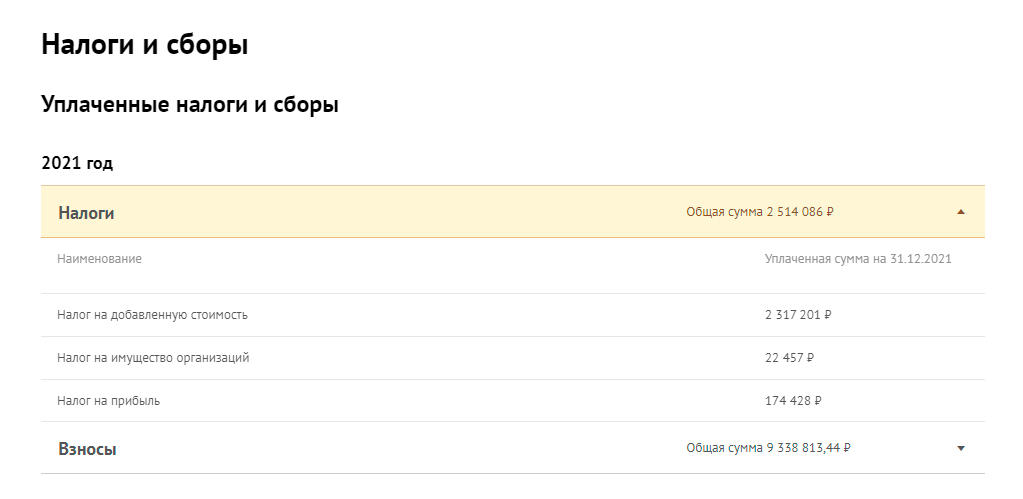

The second important thing to pay attention to is what type of taxation the company has, what taxes and fees have been paid, as well as whether the company is a debtor for the payment of taxes. This information is collected in the Taxes and Fees tab. If the company is a debtor, check whether the company's accounts are currently blocked.

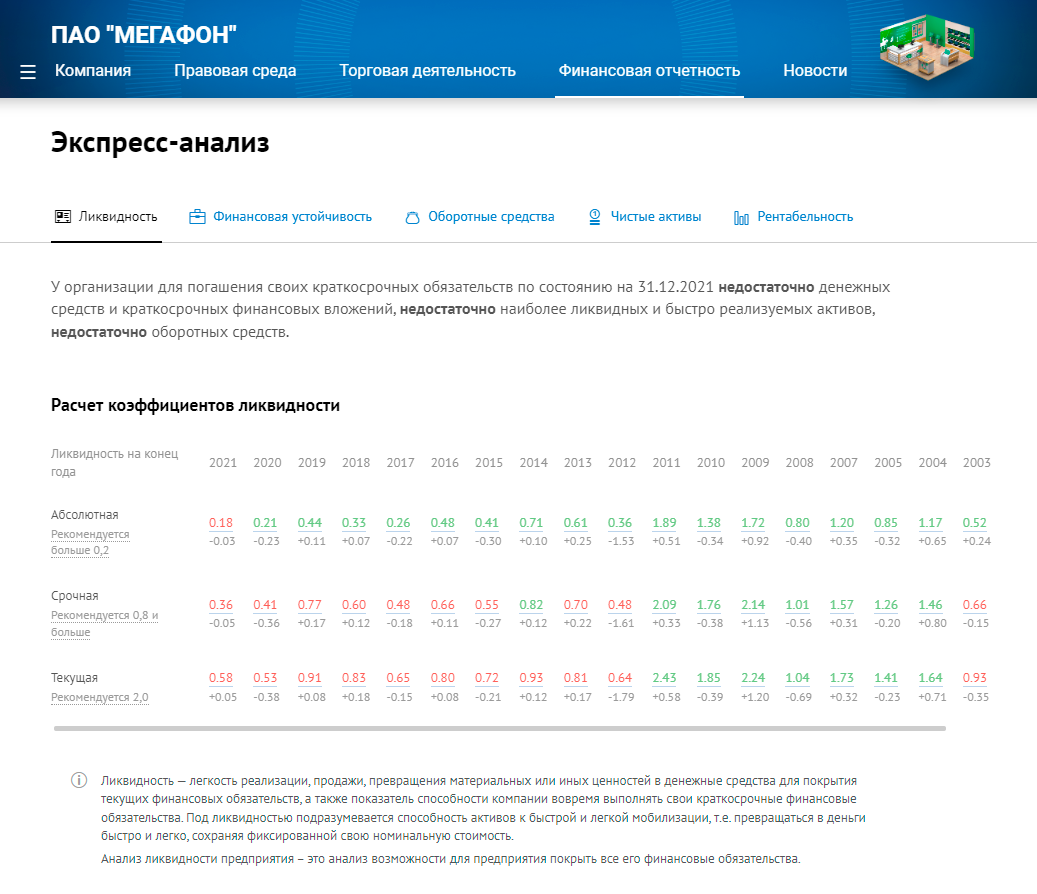

The third thing that is important and useful to pay attention to when reviewing a company is the dynamics of liquidity, profitability, financial stability and other indicators throughout the life of the company. Financial formulas are used to calculate these indicators. All data in Seldon.Basis is calculated and presented in the form of coefficients and graphs in the Express Analysis tab.

For example, if you are planning to buy a ready-made business, you should definitely assess the profitability of the company. This will make it possible to forecast profits and compare the company with competitors.

Stay tuned!